We aim to answer the big questions in life

![]()

.

We believe that a Financial Planner's role is primarily about planning and helping you achieve your objectives and not about selling financial products.

Financial planning done properly can answer life’s big questions such as:"Can I afford to retire yet?"

"How much do I need to save?"

"Will I run out of money?"

"How much is enough?"

“What rates of return do I need to generate on my investments?”

“How much do I need to sell my business for?”

If you are planning to invest, first invest in planning. The financial plan should drive the investment strategy and ensure that only the minimum investment risk is taken to achieve your goals and objectives.

Using cutting edge technology we can hep you see your financial future and model various scenarios such as downsizing property, working less hours and let you see if you can maintain the lifestyle you seek without the fear of ever running out of money.

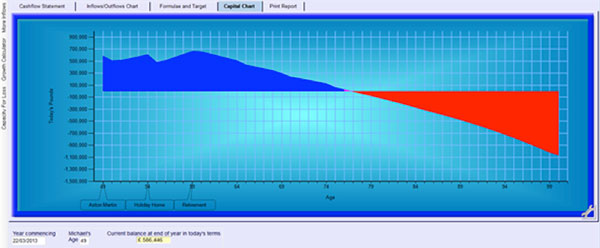

Below is an example of financial modelling in practice.

In this scenario the client will run out of money in their mid-70s which is not a particularly nice place to be.

By modelling some changes to their investment strategy and saving slightly more into their plan we are able to demonstrate their ability to retire when they want to without running out of money. Their plan would be revisited annually to ensure they remain on track.

If your existing adviser does not offer this service is it time to get a second opinion?