Job Title: Client Support Role

Company: Granite Financial Planning

Location: Banchory

Job Type: Part-time

About Us:

Granite Financial Planning is a boutique financial planning firm who work with a limited number of clients based in North East Scotland.

We are independent and specialise in retirement planning and adopt a planning-led evidence-based investment philosophy.

Job Description:

We are currently seeking a motivated and detail-oriented Client Support Administrator to join our team. The ideal candidate will play a crucial role in supporting the efficient functioning of our office to ensure clients receive an exceptional level of service.

Responsibilities:

Client Relationship Management:

Assist in maintaining strong client relationships by providing excellent administrative support.

Handle client enquiries, requests, and follow-ups with professionalism and promptness.

Documentation and Record Keeping:

Manage and organise client files, ensuring accuracy and completeness.

Prepare and process necessary paperwork related to client accounts and transactions.

Review Process:

Prepare review reports and valuations.

Help manage review calendar

Ensure the timely and accurate dissemination of appointment details to all parties involved.

Office Administration:

Perform general administrative tasks, managing emails, and handling office correspondence.

Compliance Assistance:

Assist in ensuring compliance with industry regulations and company policies.

Stay informed about regulatory changes and update documentation as required.

Data Entry and Reporting:

Input data into relevant systems accurately and in a timely manner.

Generate reports and assist in maintaining data integrity.

Collaboration:

Work collaboratively with other team members to ensure a smooth workflow.

Support financial advisers with administrative tasks as needed.

Qualifications:

Previous financial services experience in a similar administrative role essential.

Strong organisational skills and attention to detail.

Excellent communication and interpersonal skills.

Proficient in Microsoft Office Suite (Word, Excel, Outlook).

Familiarity with financial software and systems. FE Analytics, Prestwood Truth and Intelliflo are used extensively.

Knowledge of financial industry regulations and compliance is an advantage.

Education:

CII Diploma in Financial Planning or working towards.

How to Apply:

Please submit your CV and a cover letter detailing your relevant experience to This email address is being protected from spambots. You need JavaScript enabled to view it..

Granite Financial Planning is an equal opportunity employer. We encourage applications from candidates of all backgrounds and experiences.

Granite guidance

Latest from Granite Guidance...

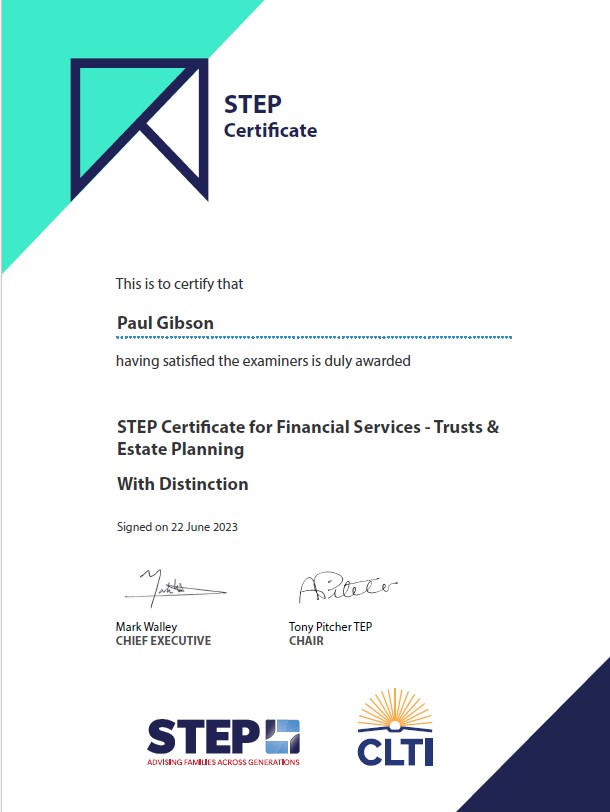

I am delighted to share the news that I have achieved a Distinction in the STEP Certificate for Financial Services - Trusts & Estate Planning. This accomplishment marks a significant milestone in my career and underscores Granite Financial Planning's commitment to excellence in providing financial guidance and expertise to our clients.

The STEP (Society of Trust and Estate Practitioners) exam is renowned for its rigorous standards and comprehensive coverage of financial services, taxation, and trusts. It tests not only one's knowledge but also their ability to apply that knowledge effectively. Attaining a Distinction in this exam came as a welcome surprise as this was the first exam I have sat for a few years.

This achievement reinforces our dedication to staying at the forefront of the financial planning profession. We believe that ongoing education and professional development are essential to provide our clients with the best possible advice and solutions for their unique financial needs.

At Granite Financial Planning, we understand the complexities of financial services, taxation, and trusts. We aim to ensure that we are equipped with the latest knowledge and expertise to navigate these intricacies, ensuring that your financial future is in capable hands.

I would like to extend my sincere gratitude to our clients for their continued trust and support. We remain committed to delivering exceptional financial planning services and look forward to continuing serving you.

Paul Gibson

Managing Director, Granite Financial Planning

We all love a bargain, hence the popularity of Black Friday in the UK which has now extended to almost every industry. I say almost as if you invest in an actively managed UK investment fund you are unlikely to find any Black Friday deals or discounts on offer.

The fund management industry in the UK is huge and manages over £6.9 trillion of assets. Charges for actively managed funds, however, remain stubbornly high with average costs estimated to be 0.9% per annum. These generally do no change whether the fund is £1million in size or £10 billion in size. Economies of scale must exist, but these are not being passed on to customers and explains why fund managers profit margins remain eye wateringly high.

Do higher charges lead to higher returns? The answer is an overwhelming no.

Standard & Poors produces regular scorecards showing that active fund managers consistently underperform against their benchmarks over the longer term.

Whilst some active fund managers do outperform the chances of predicting this in advance is in my opinion virtually nil. As Jack Bogle of Vanguard famously said, "rather than trying to find a needle in the haystack buy the haystack."

There are a band of Financial Planners who offer evidence based investment advice using low cost asset class funds to drive the investment engine. Granite Financial Planning are proud to be one of them.

As Black Friday deals are unlikely to be forthcoming if you would like to see if we can reduce your investment costs please contact us on 01330 826544.

There has been much speculation whether the government is planning to break a key manifesto pledge to maintain the triple lock by increasing the state pension by 2.5% rather than using earnings data.

What is the pension triple lock?

Introduced in 2011 by the coalition government, the triple lock guarantees that the basic state pension will rise by a minimum of either 2.5%, the rate of inflation or average earnings growth, whichever is largest.

What is the new state pension worth?

The full new State Pension is £179.60 per week. The actual amount you get depends on your National Insurance record and 35 years NI credits will provide the maximum amount.

You’ll usually need at least 10 qualifying years on your National Insurance record to get any State Pension.

The cost of buying an equivalent income using an inflation-linked annuity would be around £320,000 at today’s market rates.

The full, old basic state pension (for those who reached state pension age before April 2016) is £137.60 a week. The triple lock only applies to this element and not SERPS and S2P which were earnings related parts of the old system which are linked to inflation.

Why has Covid changed things?

As people come off furlough and return to full pay, this is recorded as a large rise in average earnings.

This leads to a unique situation, and one which economists describe as an anomaly.

Average earnings could go up by 8%, hence the equivalent rise in the state pension.

That is considerably higher than rises seen under the triple lock in the last decade.

Isn’t an increase a good thing?

Any increase in the state pension should benefit everyone over the long term but pensions are paid out of current tax receipts and those footing the bill will ultimately be those who have yet to start receiving their state pension.

The cost of each 1% rise in state pensions costs the taxpayer around £850 million per year so a large increase will have a significant impact on government finances which are already under huge pressure.

Critics say the triple lock is unsustainable in its current form, but it has undoubtedly helped to improve living standards for those in retirement.

What happens next?

The Chancellor Rishi Sunak has a difficult decision to make to ensure intergenerational fairness and to avoid any erosion of state pension benefits.

A possible alternative to scrapping the triple lock altogether would be for an adjustment to be made to reflect the unique results of the pandemic causing an artificial increase to earnings.

What should you do?

The decision will ultimately be taken by government, but it is good practice to check your state pension entitlement periodically. More information can be obtained by vising www.gov.uk/check-state-pension.

This service can help to find out: how much State Pension you could get, when you can get and how to increase it, if you can.

Paul Gibson is managing director of Banchory based Granite Financial Planning.

Granite Financial Planning Ltd is Authorised and Regulated by the Financial Conduct Authority | FCA No. 734432.

Registered in Scotland | Registered no. SC522812 | Registered address: Banchory Business Centre, Burn O’Bennie Road, Banchory, Aberdeenshire AB31 5ZU | Telephone: 01330 826544 | Email This email address is being protected from spambots. You need JavaScript enabled to view it.

The general financial planning guidance provided in this website is based on our understanding of current law and HM Revenue & Customs practice, which are subject to change in the future. Whilst every effort is made to ensure the content of this website is correct, it does not constitute personal financial advice and Granite Financial Planning Ltd cannot accept any responsibility for it. There is a risk that investment returns may not achieve the desired result. Investments can go down as well as up. The Financial Ombudsman Service (FOS) is an agency for arbitrating on unresolved complaints between regulated firms and their clients. Full details of the FOS can be found on its website at www.financial-ombudsman.org.uk. Cookies are used on this website to record visitor numbers for analytics purposes.